France is an attractive country to be tax resident

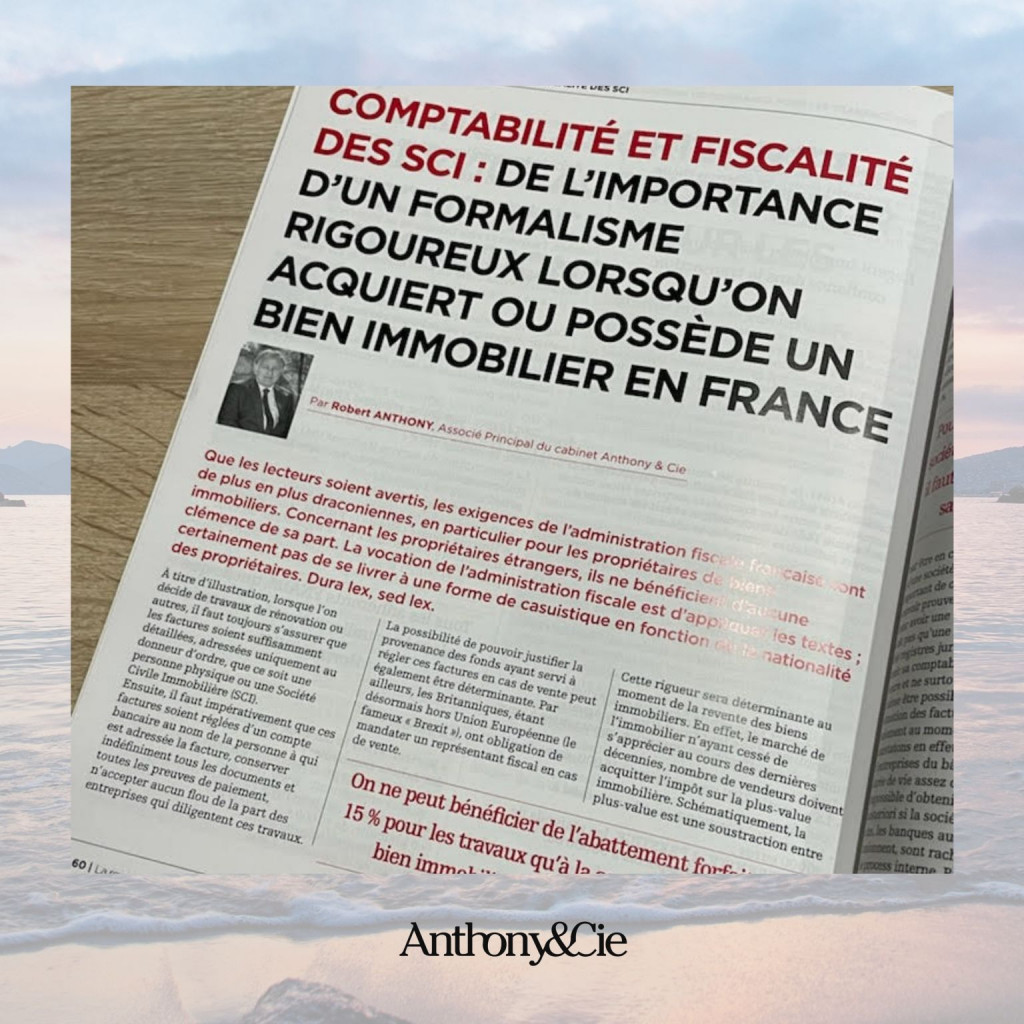

Apart from its fabulous living environment and art of living, France can also attract any wealthy foreigner looking for an attractive country of residence in terms of taxation. With good advice and careful structuring in advance of being a French tax resident, you can success in your experience. Read more details in Robert Anthony’s contribution…